Saving for a home in Sydney can feel impossible. Rising living costs and high property prices put pressure on anyone trying to get ahead. But with the right mindset and habits, it is possible to build a strong savings base and take the first steps toward buying your first home or investing in property.

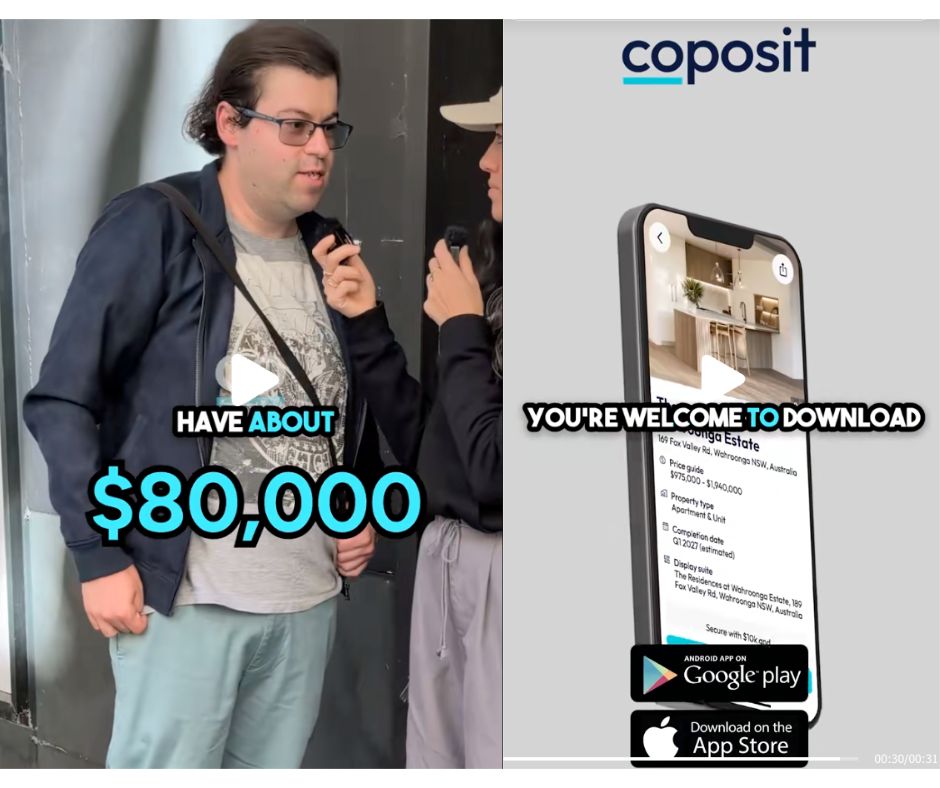

When asked how he saved $80,000 by the age of 35, one Sydney resident’s answer was straightforward.He avoids spending on expensive things and only buys when he really wants something. By focusing on what matters and avoiding impulse purchases, he has built a solid financial foundation.

This approach may sound simple, but it is powerful. It shows that you don’t need a huge income to save effectively. What matters most is consistency and being clear about your priorities.

Coposit Blog | A story from Coposit Street

Coposit Blog | A story from Coposit Street This saver works at Lowe’s and enjoys his job. Like many Sydneysiders, he finds the city expensive.However, he also points out that “if you know where to look, it’s really okay”. This reflects a key point for anyone trying to save in a high-cost city: knowing how to find value makes a big difference.

At the moment, he has no investment properties or other major assets. But when asked if he would like to get into property, he says, “If I find out about it, maybe.” This shows a common challenge — many people are interested in property but unsure how to start.

That’s where knowing the right entry points becomes important. Property investment and buying your first home don’t have to be out of reach, even in Sydney.

Saving $80,000 takes years, but the property market moves quickly. If you wait until you have a full deposit, prices may rise beyond your reach. That’s why many buyers now explore options like buying off the plan.

Buying off the plan means committing to a property before it’s built. This can lock in today’s prices and give you time to save while it’s being constructed. For first home buyers, it’s a chance to secure a home with less upfront cash.

Coposit helps Australians enter the property market with as little as $10,000. Instead of paying the entire deposit upfront, you pay it in smaller, manageable weekly instalments while your off-the-plan property is being built.

This approach is designed for people like our 35-year-old saver — those who are disciplined with money but don’t yet have a full deposit ready. With Coposit, you can:

For buyers who have good saving habits and stable income, buying off the plan offers several advantages:

Having $80,000 in savings is an impressive achievement, but you don’t need to wait until you reach that figure to buy your first home. With the right tools and strategies — like Coposit’s pay-as-you-go deposit model — you can start your property journey sooner.

If you want to learn how Coposit can help you buy your first home or invest in property off the plan, download the Coposit app today and see what’s possible.

Share this article

© 2025 Copyright Coposit.