Saving for a home in Australia can feel like a huge task. Rising living costs make it harder to put money aside each week. But many people are losing money without noticing it. The problem is unused or forgotten subscriptions.

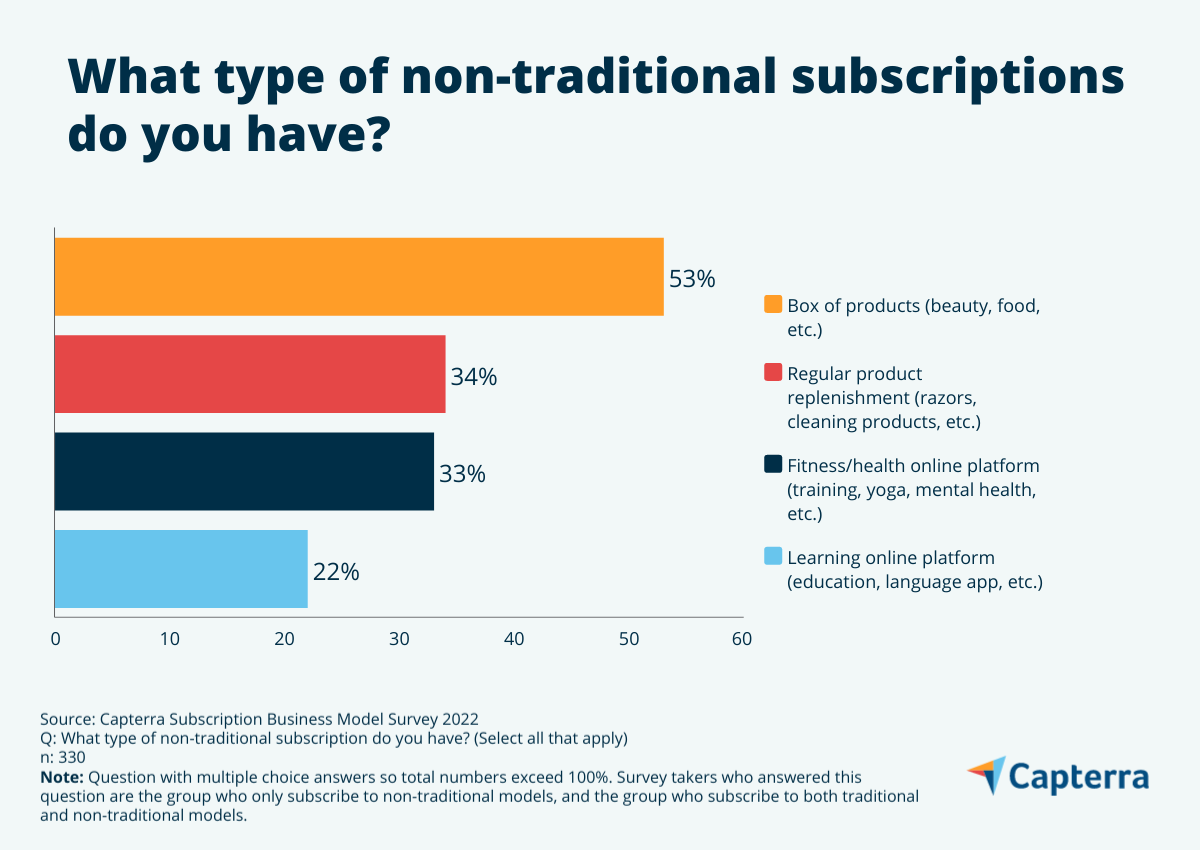

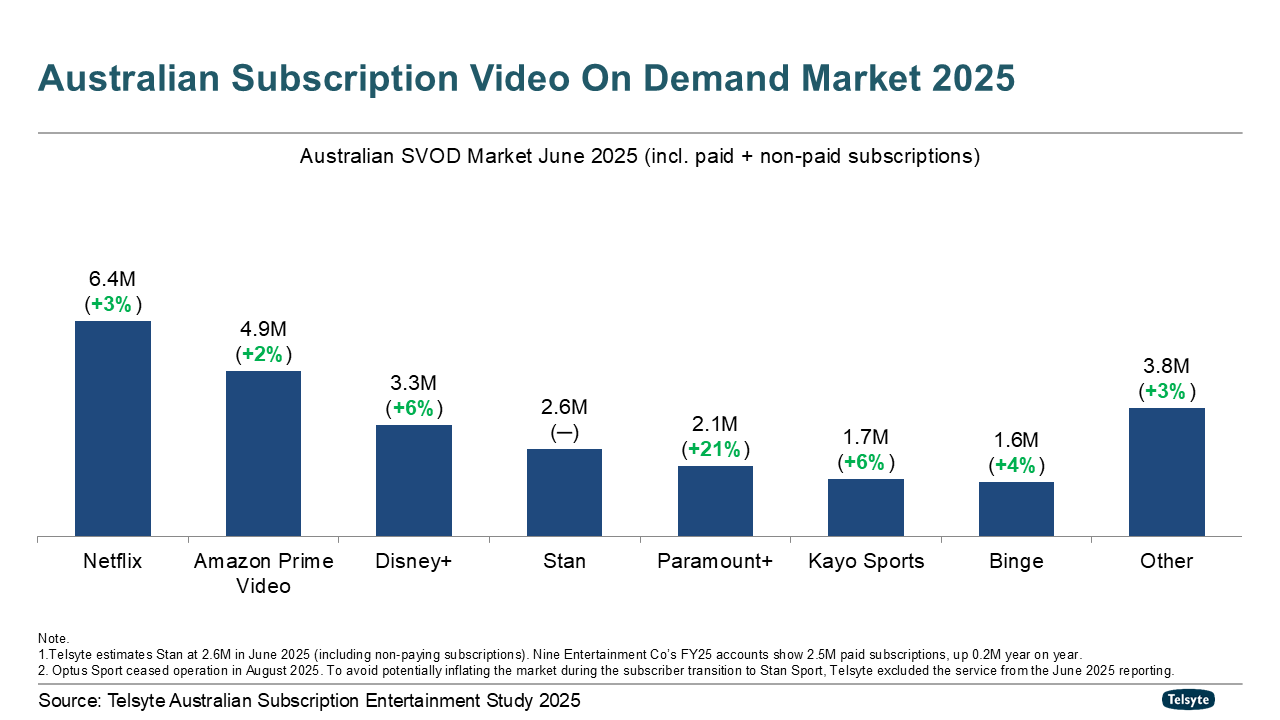

Streaming services. Apps. Delivery memberships. Extra data plans. Gym access you rarely use. It all adds up.

A subscription audit can help you take control. It shows where your money goes every month. Then you can redirect that cash towards your home deposit or your off the plan saving goals.

A subscription audit means reviewing everything you pay for on a recurring basis. You check:

It is simple. It is quick. It can make a big difference.

Coposit Blog | The Subscription Audit | Save to buy property in Sydney

Coposit Blog | The Subscription Audit | Save to buy property in SydneyMany services use automatic payments. They renew monthly or yearly without a reminder. You barely notice them:

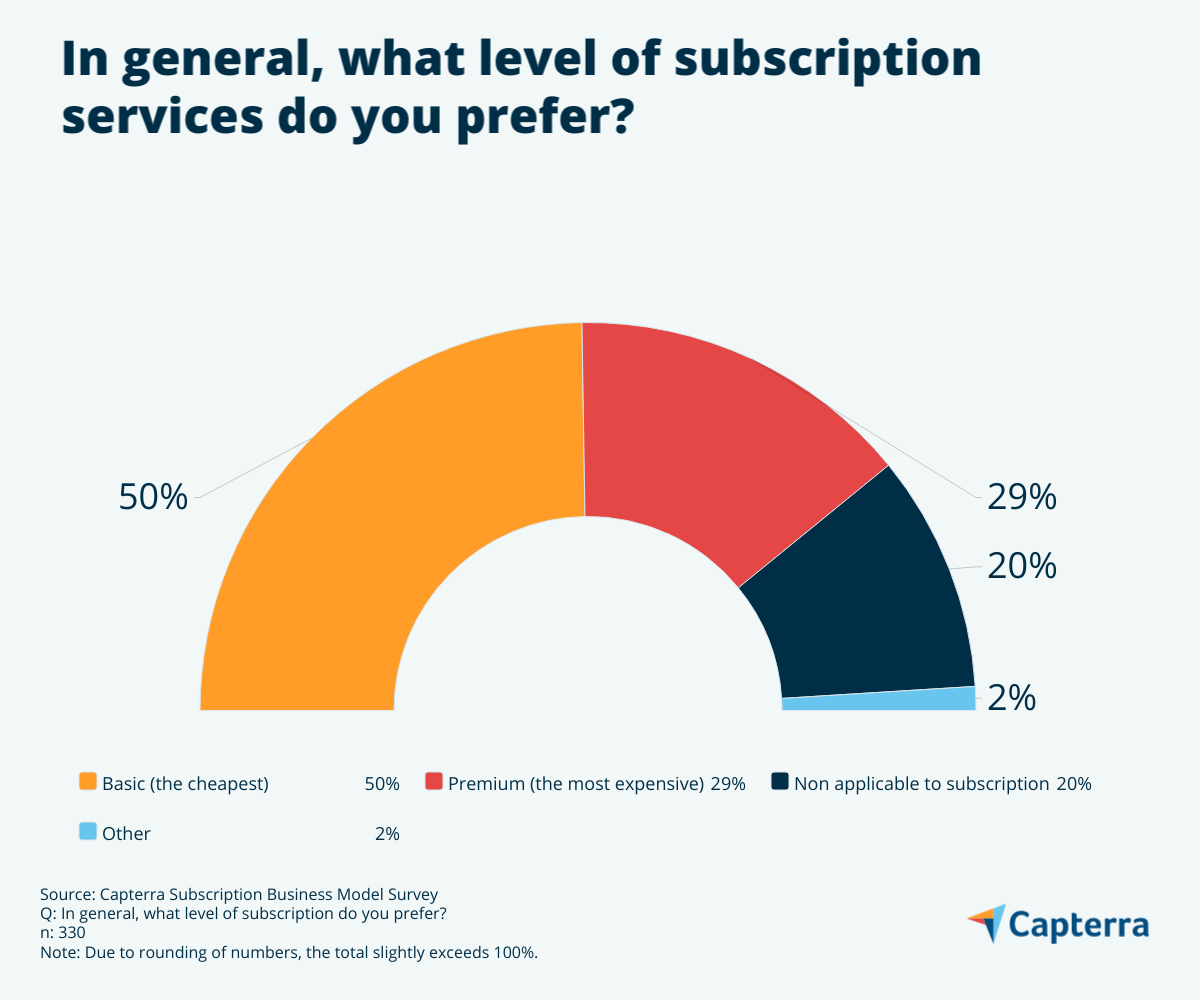

Businesses love subscriptions because they make steady profits. A subscription audit stops that money leaking out of your budget.

Coposit Blog | The Subscription Audit | Save to buy property in Melbourne

Coposit Blog | The Subscription Audit | Save to buy property in MelbourneEven removing a few unused subscriptions can boost your savings.

Example:

Total: $35 per monthYearly saving: $420In three years: $1,260 saved for your property deposit

Many Australians pay for 5 to 10 subscriptions. When you remove the ones you do not use, the savings can be much larger.

Coposit Blog | The Subscription Audit | Save to buy property in Brisbane

Coposit Blog | The Subscription Audit | Save to buy property in BrisbaneLook back at the last 3 months. Write down every repeated charge.

Ask yourself:

Do not delay. Hit cancel today. Every month counts when you are saving for a home.

Coposit Blog | The Subscription Audit | Save to buy property in Gold Coast

Coposit Blog | The Subscription Audit | Save to buy property in Gold CoastHere are simple rules to follow after your audit:

Even $10 a week becomes more than $500 a year. That money should support your future, not forgotten services.

Coposit Blog | The Subscription Audit | Save to buy property in Perth

Coposit Blog | The Subscription Audit | Save to buy property in PerthIf you are saving for a property off the plan, Coposit gives you a faster path into the market. You can secure a new home with just $10k upfront. Then you make weekly instalments while the building is completed.

Imagine this: Money saved from cancelled subscriptions goes straight into your weekly Coposit instalments. You build equity instead of paying for something you never use. A small change becomes a major win.

Coposit Blog | The Subscription Audit | Save to buy property in Canberra

Coposit Blog | The Subscription Audit | Save to buy property in CanberraTiny financial improvements compound over time. They help you move closer to owning a home.

The subscription audit is a powerful first step. You take control of your spending. You save money without changing your lifestyle much. This helps first home buyers reach their deposit goals sooner.

Property ownership starts with good habits. Cancel what you do not need. Keep what matters. Turn your everyday savings into progress towards your home.

Share this article

© 2025 Copyright Coposit.